Contents

Urban World: The Shifting Global Business Landscape

Emerging markets are changing where and how the world does business. For the last three decades, they have been a source of low-cost but increasingly skilled labor. Their fast-growing cities are filled with millions of new and increasingly prosperous consumers, who provide a new growth market for global corporations at a time when much of the developed world faces slower growth because of aging. But the number of large companies from the emerging world will rise, as well, according to a new report from the McKinsey Global Institute (MGI). This powerful wave of new companies could profoundly alter long-established competitive dynamics around the world. Our research shows that the emerging economies’ share of Fortune Global 500 companies will probably jump to more than 45 percent by 2030, up from just 5 percent in 2000. That’s because while three-quarters of the world’s 8,000 companies with annual revenue of $1 billion or more are today based in developed economies, we forecast that an additional 7,000 could reach that size in little more than a decade—and 70 percent of them will most likely come from emerging markets. To put this dramatic shift in the balance of global corporate power in perspective, remember that many of the world’s largest companies have maintained their current status for generations: more than 40 percent of the 150 Western European companies in last year’s Fortune Global 500 had been founded before 1900.

Corporate leaders can’t afford to be complacent about a change of such magnitude. In fact, we have seen all this before. In the 1970s and 1980s, Japanese carmakers began gaining global market share and, in some cases, outcompeted their US counterparts. More recently, South Korea’s Samsung has weakened Apple’s grip on the global smartphone market. In the decade ahead, this type of story will play out on a much bigger scale, and the rate at which newcomers topple industry leaders will probably accelerate. Such up-and-coming companies could disrupt entire industries by designing superior products at lower cost, by bringing them to market faster, and by streamlining business processes. Many of these businesses, having been nurtured in difficult operating environments, are not only more agile than their counterparts from advanced economies but also prepared to invest for the long term, even if this cuts earnings in the next few quarters. Many new players will be setting their sights on expanding into international markets. Business leaders will have to monitor trends constantly to spot new markets and competitors. They need to meet three imperatives.

- Optimize sales networks. The growth of new businesses is not only a competitive threat to older ones but also gives suppliers and service providers a significant opportunity. B2B companies will need to assess how to organize themselves so they can sell to a much more diverse and dispersed customer base. To do so, they must rethink (and perhaps redeploy) their sales networks.

- Understand how customers and competitors are evolving. New industry hotspots will be sources of both competition and demand, so companies must track up-and-coming hubs in emerging regions. Hsinchu (in northern Taiwan) and Brazil’s Santa Catarina metropolitan district, for example, may not be household names, but they are already hubs for multiple billion-dollar companies in industries such as advanced electronics.

- Reconsider the headquarters configuration and the location of other core activities. Already, many businesses find that the traditional single-headquarters model no longer meets their needs. Companies such as Caterpillar and General Electric have thus split their corporate centers into two or more locations that share decision making, production, R&D, and service leadership. Unilever created a second headquarters, for global development, in Singapore, which now has key members of the company’s senior-leadership team.

In emerging regions, the leading cities for business today are likely to capture a disproportionate share of company growth in the future. The number of large companies based in São Paulo, for instance, could more than triple by 2030. Beijing and Istanbul could have more than twice as many head offices as they do today. Yet company headquarters will become more dispersed across the emerging world: about 280 of its up-and-coming cities could host a large company for the first time, thus becoming new hubs in global industry networks. Although many city officials focus on luring corporate head offices, relatively few companies actually move them. But as thousands of global businesses expand into new markets, giving themselves a real choice of locations, the more promising opportunity for cities lies in attracting foreign subsidiaries. China is without a doubt the most powerful growth engine for new global companies, and now is the time for forward-thinking cities to build their reputations among its business leaders. The largest foreign subsidiaries cluster heavily in just a few key cities in each region of the world. Thanks to the highly effective efforts of Singapore’s economicdevelopment board, that country is far and away the location of choice for Western multinationals setting up operations in Asia’s emerging economies. Other cities should learn from Singapore’s approach. The quality of the business environment isn’t the only consideration. Cities with reputations for a high quality of life—such as Prague, Sydney, and Toronto—have been more successful than others in attracting the foreign operations of multinationals. But in selecting locations for future expansion, the emerging world’s more diverse companies may consider a broader set of criteria, including the personal ties of executives educated abroad, the need to diversify family holdings, reputation building at home, or an exceptional willingness to enter frontier markets.

The rebalancing of the global business landscape will probably be even faster and more dramatic than the shift of economic growth to emerging regions. Large companies matter, and not just for their ability to create jobs and generate higher incomes; they are also forces for increased productivity, innovation, standard setting, and the dissemination of skills and technology. Their geographic shift will have profound implications for the nature of competition, including not only the race for resources and talent but also, more broadly, the emerging markets’ efforts to reach the next level of economic development and prosperity.

Extracted from: https://www.mckinsey.com/featured-insights/urbanization/urban-world-the-shifting-global- businesslandscape

QUESTION 1 (100 Marks)

- The case study illustrates how Samsung has strategically disrupted Apple’s dominance in the global smartphone industry—an example of how emerging competitors are increasingly challenging established market leaders. Critically analyse the underlying factors driving this accelerating trend of industry disruption over the next decade. Drawing on relevant academic literature and practical examples, appraise the strategic priorities industry leaders should adopt to safeguard their market positions and respond effectively to competitive threats.

(25 marks)

- Global retail giant DresdenMart International is planning to expand its operations into new emerging markets, with a strategic focus on Asia and Africa. The executive team has acknowledged that selecting the right market location will be critical to the long-term success and profitability of this expansion. As a consultant appointed to support this initiative, critically discuss the methodological approach DresdenMart International should adopt when selecting new market locations in Asia and Africa. Your response should incorporate a clear step-by-step process, consider both macro- and micro- environmental factors, and make use of practical examples from similar retail expansion cases to support your recommendations.

(25 marks)

- The case study presents China as a key driver of growth for emerging global enterprises. As an operations management professional in a manufacturing organisation, critically assess this perspective. Support your response with relevant operational and strategic considerations.

(25 marks)

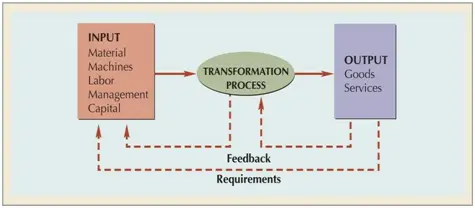

- Using the diagram provided as a reference, examine how value creation occurs throughout the transformation process. In your response, appraise the key activities associated with each stage of the process and illustrate your analysis with practical examples from leading global organisations.

(25 marks)

Strategy Assignment Answers: Expert Answers on Above Questions

Industry disruption and strategic priorities

Key factors that are driving disruption include the cost and innovation advantage, agility and speed, global consumer demand and accessibility to technology. Highly established players like Samsung create innovative products with high quality design at lower cost, and they are very fast in adopting to challenges posed by home markets.

Strategic priorities for leaders:

The strategic priorities should be to make continuous investment in innovation, and enter into strategic alliances in the emerging markets. It also includes enhancing the supply chain resilience, and applied data analytics for better services to consumers.

Approach for market selection

The step by step process that needs to be followed in selecting the market includes performing a macro analysis first using PESTLE framework, analysing market attractiveness through evaluating GDP growth, urbanization and retail penetration, and performing a critical competitive analysis. This is followed by performing a micro analysis analysing consumer preferences, evaluating risk levels and entry mode, and conducting pilot testing.

| Disclaimer: This answer is a model for study and reference purposes only. Please do not submit it as your own work. |

Want Detailed Answers with References?

Check Samples on Strategy Written by Experts

Related answer

Strategic Market Entry Analysis for a Retail Chain

Takealot Strategic Management Case Study Assignment

Chinten Technologies Expands into Kenya’s Emerging BI Market

Clearview Windows Limited: Case Study & Strategy Analysis

Pick n Pay’s Strategic Transformation and Effectiveness

Vision and Mission Analysis of Dangote Group

LJMU-7503-UNIMBA Operationalizing the Strategy

Strategic Growth Analysis of Yuppiechef in South Africa

Finding real value in environmental footprints Answers

You have been hired as a Competitive Intelligence Analyst Answers