Flowers Group Consolidation Case – 30 June 2025

QUESTION 1 (100 marks)

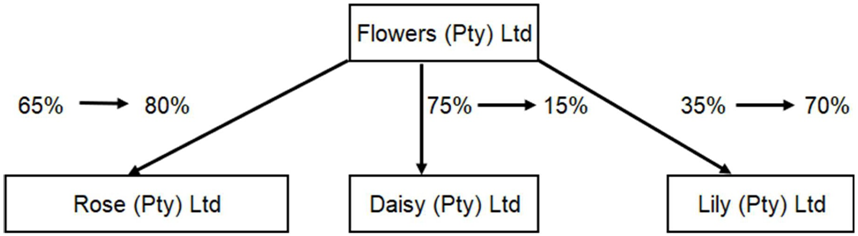

Flowers (Pty) Ltd (“Flowers”) is a company that operates in the retail industry. The company was founded in 2010, and it owns various investments in other entities through which it expands its operations. All companies in the group have a 30 June financial year-end.

The Flowers Group currently consists of the following entities:

The following abridged trial balance for the financial year ended 30 June 2025 is available for Flowers:

Flowers (Pty) Ltd Dr/(Cr)

Stated capital (R500 000)

Retained earnings (1 July 2024) (R5 874 690)

Total assets R11 309 690

Total liabilities (R2 587 200)

Profit for the year (R2 485 020)

Fair value gain investment in Daisy – after tax (OCI) (R62 780) Dividend paid – 30 June 2025 R200 000

Rose (Pty) Ltd (“Rose”)

The following abridged trial balance for the financial year ended 30 June 2025 is available for Rose:

Rose (Pty) Ltd Dr/(Cr)

Stated capital (R100 000)

Retained earnings (1 July 2024) (R578 300)

Total assets R1 145 302

Total liabilities (R254 660)

Profit for the year (R166 870)

Fair value gain on financial assets – after tax (OCI) (R45 472)

Flowers purchased 65% of the ordinary share capital of Rose on 1 March 2024 for R230 000 and obtained control of Rose on this date. At acquisition, Rose had a stated capital of R100 000 and retained earnings of R235 400. All of Rose’s assets and liabilities were considered fairly valued at the acquisition date, and no additional assets, liabilities, or contingent liabilities were identified at the acquisition.

On 31 January 2025, Flowers acquired an additional 15% of Rose’s ordinary share capital for R130 000.

The fair value gain on financial assets that Rose recognised at year end is in relation to a share portfolio that Rose acquired during the 2025 financial year. None of the assets in the share portfolio was sold during the 2025 financial year. At the acquisition date, Rose elected to recognise subsequent changes in the fair value of the share portfolio in other comprehensive income.

Daisy (Pty) Ltd (‘’Daisy’’)

The following abridged trial balance for the financial year ended 30 June 2025 is available for Daisy:

Daisy (Pty) Ltd Dr/(Cr)![]()

Stated capital (R200 000)

Retained earnings (1 July 2024) (R877 500)

Total assets R1 319 500

Total liabilities (R135 600)

Profit for the year (R256 400)

Dividend paid – 1 November 2024 R150 000

Flowers purchased 75% of the ordinary shares in Daisy on 1 July 2023 for R760 000. Flowers obtained control of Daisy on the acquisition date. On this date, Daisy had a stated capital of R200 000 and retained earnings of R687 900. All of Daisy’s assets and liabilities were considered fairly valued, except for the Daisy™ trademark, which was undervalued by R120 000. The group expects to recover the carrying amount of the Daisy™ trademark through use. On the acquisition date, the remaining useful life of the Daisy™ trademark was estimated to be 5 years with a zero residual value.

On 1 December 2024, Flowers disposed of 60% of the ordinary shares in Daisy (i.e., Flowers had a remaining interest of 15% in Daisy) for R650 000. The disposal resulted in Flowers losing control over Daisy. Assume that this disposal did not have a tax effect in the separate financial records of Flowers.

The remaining investment in Daisy was classified as a financial asset at fair value through other comprehensive income in accordance with IFRS 9 Financial Instruments in Flowers’s separate financial statements. The remaining investment in Daisy had a fair value of R185 000 on 1 December 2024 and R200 000 on 30 June 2025.

Lily (Pty) Ltd (“Lily”)

The following abridged trial balance for the financial year ended 30 June 2025 is available for Lily:

Lily (Pty) Ltd Dr/(Cr)![]()

Stated capital (R150 000)

Retained earnings (1 July 2024) (R655 200)

Total assets R994 500

Total liabilities (R157 800)

Profit for the year (R101 500)

Dividend paid – 30 June 2025 R70 000

Flowers purchased a 35% investment in Lily on 1 August 2022 for R310 000. From this date, Flowers exercised significant influence over Lily. On the acquisition date, Lily’s equity comprised of stated capital of R150 000 and retained earnings of R687 900. All Lily’s assets and liabilities were considered fairly valued, and no additional assets, liabilities, or contingent liabilities were identified on the acquisition date.

On 1 February 2025, Flowers purchased a further 35% investment in Lily for R260 000, from a shareholder who had to sell their investment urgently for financial reasons. Through this further 35% investment, Flowers obtained control of Lily. At the acquisition date, all Lily’s assets and liabilities were considered fairly valued, and no additional assets, liabilities, or contingent liabilities were identified.

The fair value of Flowers’s initial 35% investment in Lily was R340 000 on 1 February 2025.

From 1 March 2025, Flowers started purchasing inventory from Lily. On 30 June 2025, Flowers’s inventory included inventory with a value of R80 000, which was purchased from Lily. The inventory was sold by Lily to Flowers at cost plus a markup of 15%.

Additional information:

Flowers elected the following policies:

Non-controlling interest is measured at its proportionate share of the acquiree’s identifiable net assets at acquisition.

Investments in subsidiaries and associates are measured at cost in its separate financial statements.

Fair value gains/losses on financial assets recognised through other comprehensive income are transferred to retained earnings on the disposal of the financial assets.

Items of other comprehensive income are presented net of related tax in the Statement of Profit or Loss and Other Comprehensive Income.

Reclassification adjustments are presented in the Statement of Profit or Loss and Other Comprehensive Income.

Assume that the profit for the year for all companies accrued evenly throughout the year.

Assume a company tax rate of 27% and a capital gains tax inclusion rate of 80%.

Ignore VAT.

REQUIRED:

Calculate the total consolidated gain or loss that will be recognised in the consolidated financial statements of the Flowers (Pty) Ltd Group for the 30 June 2025 financial year arising from the loss of control of the investment in Daisy (Pty) Ltd.

(25 marks)

Prepare the abridged Consolidated Statement of Profit or Loss and Other Comprehensive Income for the Flowers (Pty) Ltd Group for the year ended 30 June 2025.

Show all calculations.

Round all answers to the nearest Rand.

Comparative figures are not required.

Notes to the financial statements are not required.

(43 marks) Communication skill: Presentation (1 mark)

Prepare the Consolidated Statement of Changes in Equity for the Flowers (Pty) Ltd Group for the year ended 30 June 2025.

Show all calculations.

Round all answers to the nearest Rand.

Comparative figures are not required.

Notes to the financial statements are not required.

The total column of the statement is not required.

Accounting Assignment Answers: Expert Answers on Above Accounting Questions

Answer 1: The calculation of total consolidated gain or loss that will be recognised in the consolidated financial statements of Flowers pty Limited group for the 30 June 2025 is calculated as follows:

IFRS gain/loss: Consideration received + fare value of retained interest – carrying amount of disposed portion.

Consideration received a6 60% disposal = R650000

Fare value of retained interest at 15% disposal = R1850000

Calculation of caring amount of Daisy in the consolidated books

Net assets at acquisition: R1007900

Accumulated profits: R296433

Trademark amortization: R34000

Dividend paid: R150000

Carrying amount = 1007900+296433-34000-150000

=R1120333

Add Goodwill: 5433

Carrying amount at 100% = R1125766

at 60% = R675460

Gain/loss = R650000+R185000-675460

=R159540

| Disclaimer: This answer is a model for study and reference purposes only. Please do not submit it as your own work. |

Want Detailed Answers with References?

Check Samples on Accounting Subject Written by Experts

Related answer

Online PPE Business Costing and Investment Proposal

Construction Accounting, Disruptions & Life-Cycle Costing

Reef Ltd & Ray Ltd Consolidation | IFRS Group Accounts 2024

Accounting & Managerial Finance — EOQ, Ratios, CVP

Budgets, Ratio Analysis & Capital Financing in Accounting

Established Manufacturers Case Study & Financial Analysis

Cosmed Limited: 2023 Cash Flows, 2024 Ratios & 2026 Project

EcoGrid SunGrid Expansion & VitaPharm ROE Analysis

Financial Accounting Assignment – VAT, Journals & More

Tax Case Study: HOD Pty Ltd & Special Trust Implications